5 Surprising Lessons from the 1929 Crash That Echo Louder Than Ever Today

Share

Introduction: Beyond the Black-and-White Photos

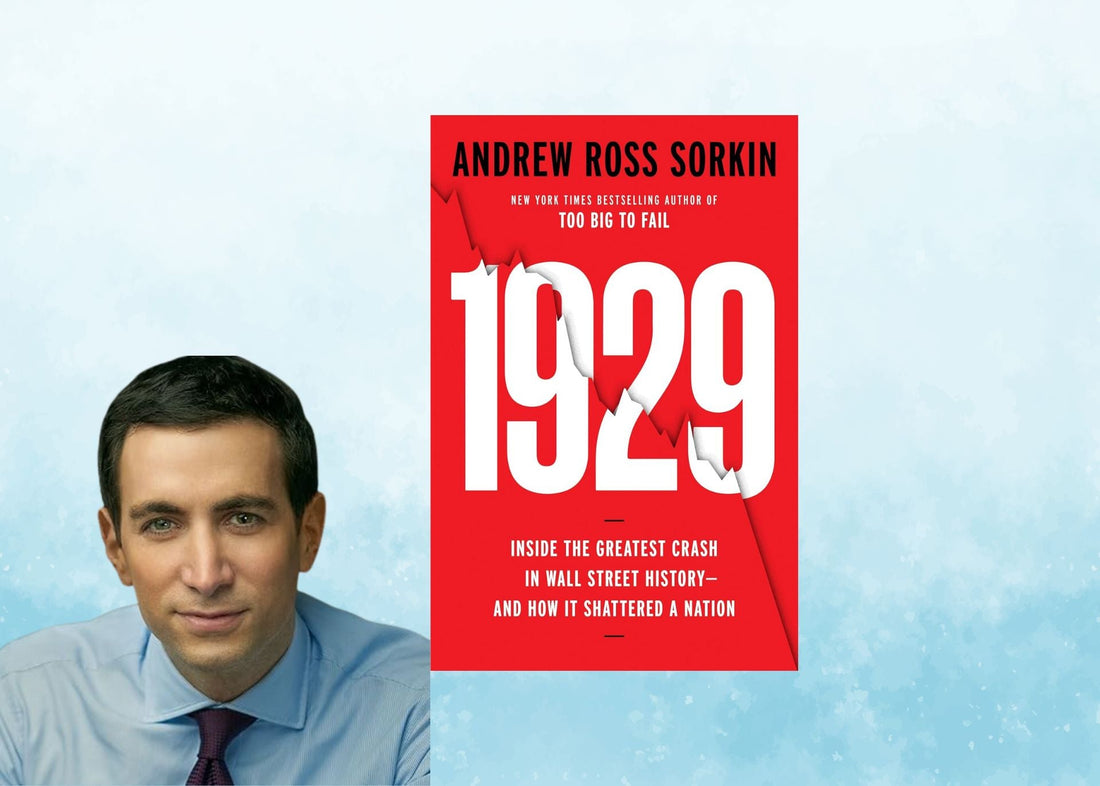

When we think of the 1929 stock market crash, the images are often distant and grainy: crowds of men in hats, ticker tape on the streets, a historical event confined to textbooks. But according to insights from eight years of archival research by Andrew Ross Sorkin for his book, 1929: Inside the Greatest Crash in Wall Street History and How It Shattered a Nation, the human drama and financial dynamics of that era are shockingly relevant. The crisis wasn't just an economic event; it was a story of choices, characters, and failures that holds a mirror to our modern world.

This isn't just about what happened then; it's about understanding the psychological forces that persist today. Here are five counter-intuitive takeaways from Wall Street's greatest crash that challenge what we think we know and offer a powerful cautionary tale for our own time.

1. Before the 1920s, Personal Debt Was a "Moral Sin"

The culture of easy credit we take for granted today had a distinct and radical beginning in the years leading up to the crash. Before the 1920s, taking on a personal loan was widely considered a moral failing. This cultural norm was completely upended by an unlikely innovator: General Motors, which began offering loans to help ordinary people buy cars.

Wall Street quickly seized on this new model and applied it to stock speculation. Brokerages began appearing on street corners "like Starbucks," where anyone could walk in and bet on the market. The terms were intoxicatingly simple: "YOU COULD PUT DOWN A DOLLAR. THEY WOULD LOAN YOU $10." This flood of borrowed money, or leverage, fueled a speculative frenzy that sent the market soaring 90% in the single year of 1928. It shows how a fundamental shift in society's relationship with debt can create the conditions for a massive bubble.

2. The Crash Unfolded in an Information Black Hole

In today's world of instant stock quotes and breaking news alerts, it's hard to imagine a financial crisis playing out in slow motion. Yet, that's exactly what happened in 1929. As the market began to plummet, the technology of the day couldn't keep up. According to Sorkin's account, the stock market ticker numbers were running "five hours behind."

This created a chaotic information vacuum. People had no way of knowing what was happening to their money, which only amplified the panic. The famous photos of crowds gathered on Wall Street weren't just for protest; people were physically rushing to brokerage houses and the steps of the stock exchange in a desperate attempt to find out what was going on. The panic was fueled not just by falling prices, but by the terrifying absence of reliable information.

3. Today's AI Hype Has a Haunting 1929 Parallel

The belief that "this time is different" is a recurring theme in financial history. Sorkin draws a direct and unsettling parallel between the speculative fervor of the 1920s and today's market dynamics. He points out that the boom of that era was driven by an exciting new technology: the radio.

His core concern is that a massive boom in one groundbreaking sector can mask underlying vulnerabilities in the broader economy, especially when leverage is involved. The excitement around a single innovation can create a sense of irrational exuberance that ignores other warning signs. Sorkin notes:

...THERE'S AN EXCITING THING IN 1929 CALLED RADIO, AND PEOPLE WERE BUYING, RCA, THE WAY THEY BUY STOCK IN NVIDIA TODAY.

4. The Collapse Left Psychological Scars for a Lifetime

Beyond the financial devastation, the crash inflicted deep and lasting psychological trauma on a generation of Americans. Sorkin shares a powerful personal anecdote about his own grandfather, who was an 11-year-old messenger boy on Wall Street during the crash.

His grandfather witnessed someone jump from a window after the market collapsed, an image that haunted him for the rest of his life. The result was a profound and permanent shift in his relationship with money and risk. As Sorkin recounts, "He lived until he was 91 years old. Never bought a share of stock his whole life." This story illustrates how the event created a generational fear of the market that transcended mere financial loss, shaping financial behavior for decades to come.

5. The Financial Safeguards We Rely On Were Born from This Catastrophe

While the 1929 crash was a story of catastrophic failure, it was also a transformative event that permanently reshaped American finance. The disaster forced a fundamental rethinking of the role of government in markets, shifting the balance of power between Wall Street and Washington.

In the aftermath, landmark reforms were enacted to protect ordinary investors and prevent a repeat of the disaster. These included the passage of the Glass-Steagall Act, the creation of the Securities and Exchange Commission (SEC), and the establishment of federal deposit insurance. These systems, designed to act as guardrails for the financial system, are a direct legacy of the 1929 collapse. However, Sorkin adds a modern-day warning, expressing concern that some of these "guardrails are being taken off right now."

Conclusion: History Rhymes

The 1929 crash is far more than a historical relic. It serves as a mirror reflecting the persistent aspects of human nature that drive financial cycles: greed, fear, hubris, and the seductive allure of the belief that "this time is different." The characters and choices from a century ago feel eerily familiar because the underlying psychology remains the same. As new technologies ignite new booms, we must ask: Have we truly learned the lessons from a century ago, or are we condemned to hear history rhyme once more?

Get the book here